Lead capture, auto-allocation, customer onboarding, document validation, loan processing.

Building Tomorrow Today

Aadhar Housing lays out a comprehensive blueprint to solidify its leadership in the housing finance market. The Company charts a course toward sustainable growth and substantial impact by prioritising innovation, distribution, customer-centricity, and operational excellence. This strategic focus not only prepares us for future challenges but also cements our commitment to making a meaningful difference in the lives of our customers.

Expanding the Distribution Network for Deeper Market Penetration

Aadhar Housing is expanding its distribution network across India to meet the growing demand from urbanisation. The Company strategically places its branches, from main to ultra-micro branches, to efficiently cater to diverse market demands. This structured approach helps control operational costs and ensures optimal service at each location. By analysing demographics and market trends and employing the AGU product for market testing, Aadhar Housing aligns its expansion with actual market needs. Ongoing evaluations enable the Company to adjust its strategy, ensuring effective market penetration and improved service delivery.

Enhancing Reach in Target Segments

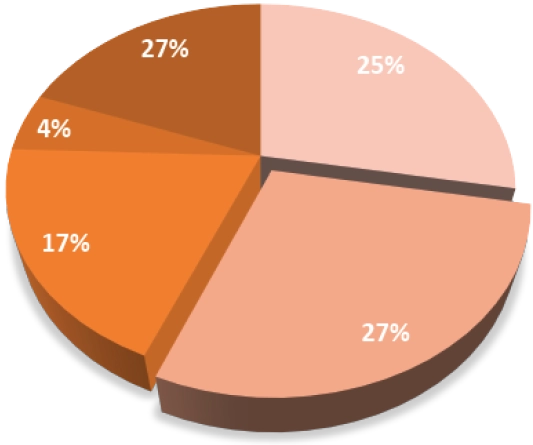

In FY 2024, Aadhar Housing significantly expanded its customer base, serving over 266 thousand live accounts, primarily drawn from economically weaker and low-to-middle-income segments. The Company’s strategic focus remains steadfast on the Low-Income Group (LIG) and Economically Weaker Sections (EWS), with a modest contribution from the Middle-Income Group (MIG). Despite the challenges of low mortgage penetration in India-largely due to variable income levels and the prevalence of informal employment-the prospects for growth are notably promising. Aadhar Housing prioritises low-income housing, leveraging digital innovations to widen access to its financial solutions.

23

Ultra-micro Branch

140

Sales Offices

88

Micro Branch

131

Main Branch

141

Small Branch

Tech-Powered Transformation: Streamlining Operations for Superior Service

In FY 2024, Aadhar Housing significantly expanded its customer base, serving over 266 thousand live accounts, primarily drawn from economically weaker and low-to-middle-income segments. The Company’s strategic focus remains steadfast on the Low- Income Group (LIG) and Economically Weaker Sections (EWS), with a modest contribution from the Middle-Income Group (MIG). Despite the challenges of low mortgage penetration in India-largely due to variable income levels and the prevalence of informal employment-the prospects for growth are notably promising. Aadhar Housing prioritises low-income housing, leveraging digital innovations to widen access to its financial solutions.

AHFL Customer App Downloads

IT Data Center - Mumbai

IT Data Recovery Center - Hyderabad

Lending and Securitisation Platform (Developed by TCS)

Optimising Borrowing Costs and Reducing Operating Expenses Further

Aadhar Housing Finance Ltd. diligently works to sustain its net interest margin (NIM) through strategic financial operations to diversify funding sources and refine asset- liability management practices. Initiatives include:

By increasing the share of National Housing Bank (NHB) refinancing and accessing international capital markets, the Company strategically reduces borrowing costs and enriches its funding mix.

Leveraging a robust distribution and collections infrastructure, Aadhar Housing enhances operating leverage, significantly curtailing operating expenses.

Strategic investments in technology and digitisation are pivotal in reducing operating expenses and credit costs, ensuring streamlined operations across all levels.

Direct Selling Team Members

Aadhar Mitras

Borrowing Relationships

.svg)